Trust & Estate Considerations for Art & Collectible Owners and Inheritors

Owning and ultimately gifting art and collectibles brings unique challenges to its current owners and potential inheritors. Unlike traditional investments ...

The Money (and Style) Message Pit: Do Childhood Money and Style Messages Rob Us of Agency?

By Randy Kaufman and Andrea Greenspan Reprinted with permission from Randy Kaufman. Randykaufman.com© with research assistance from Dustin Lowman, Guitar ...

Fiduciary Governance Planning for Your Nonprofit Endowment or Foundation

Content adapted from an article originally published by, and used with permission from, Fiducient Advisors LLC. A robust governance framework ...

A Guide to Spending Policies for Nonprofits

Content originally published by, and used with permission from, Fiducient Advisors LLC. “The name of the investment game is not ...

What You Should Know When Creating Investment Policy Statements

Content originally published by, and used with permission from, Fiducient Advisors LLC. Most experienced nonprofit board and committee members understand ...

Financial Planning for Dentists: Navigating the Unique Challenges

In many ways, the dental profession is thriving and provides a rewarding career for entrepreneurs. Consider that the median pay ...

Is a “Backdoor Roth IRA” a good idea?

This is a question that is coming up more frequently, especially from those who wish to defer taking money from ...

My Sunny and Warm Tax Haven

After spending a few days recently in the warmth of Miami, I always wonder why I do not live in ...

3 Things to Know About Financial Planning for People with Disabilities

Financial planning can already be a daunting task, but for those with disabilities, there are added complexities that need to ...

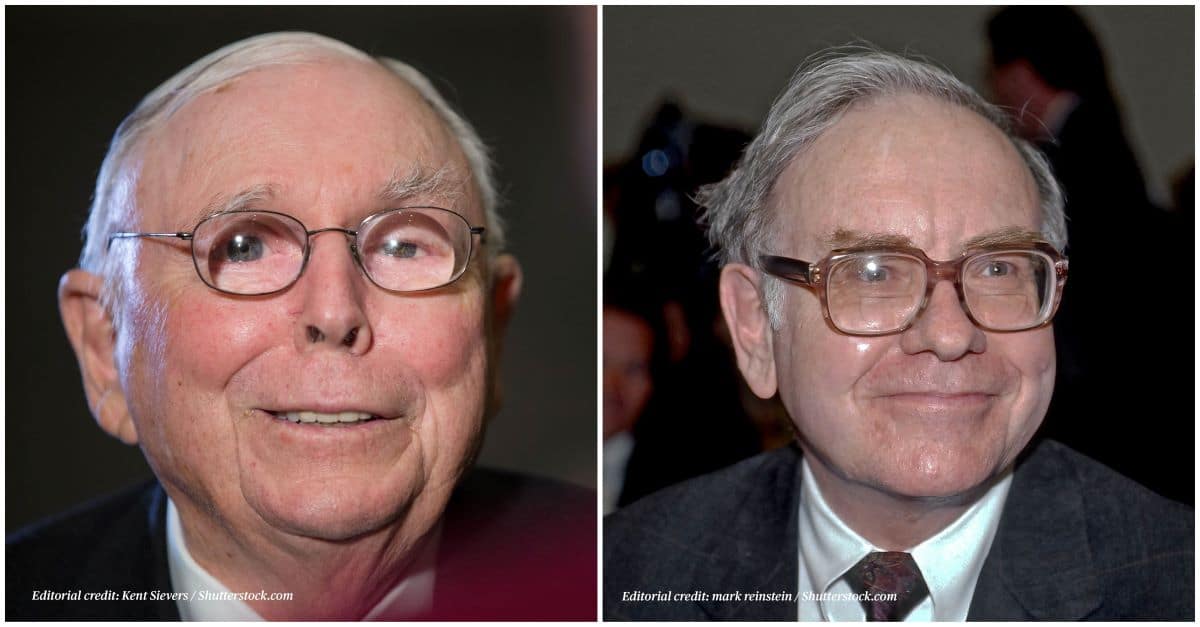

The Abominable No-Man and the Oracle of Omaha

The recent passing of Charlie Munger, Vice Chairman of Berkshire Hathaway, made us reflect on his and Warren Buffet’s successful ...

Maximizing Financial Success in Big Law: A Guide for Associates at Different Career Stages

As the compensation landscape for Big Law associates continues to evolve, new financial implications also arise, making it more important ...

How Savvy Investors Plan for Education Expenses

There is a changing reality for many parents – advanced planning and a long-term strategy for financing a child’s education ...